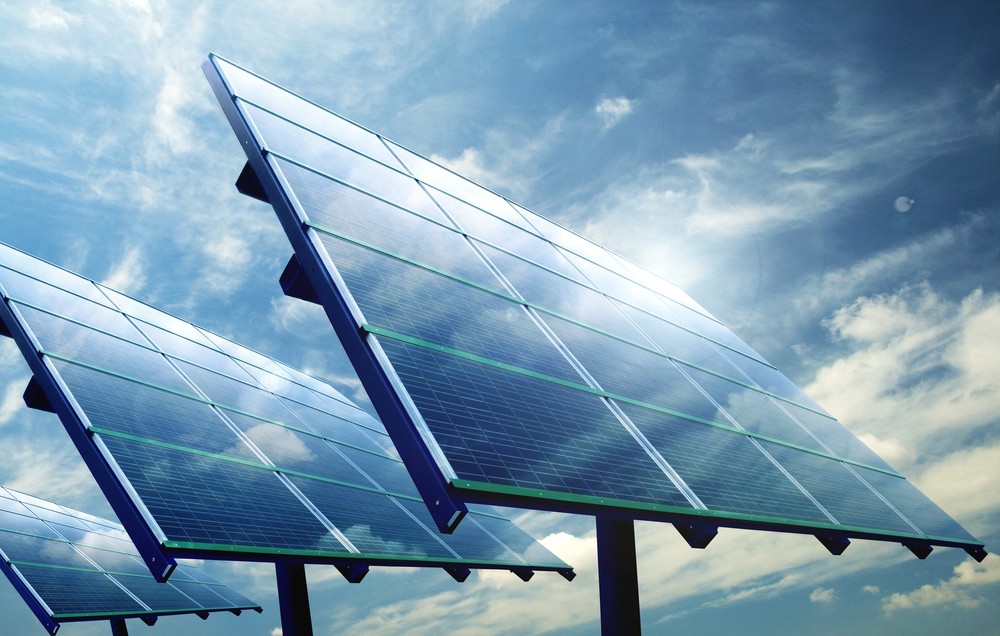

Why does China Lead the Solar Manufacturing Market?

As per a new report by International Energy Agency (IEA), China is responsible for manufacturing and supplying more than 80% of the world’s solar photovoltaic panels. Nevertheless, China will own 95% of solar manufacturing processes by 2025.

The increasing global demand for solar gear and domestic pressure on solar manufacturing has propelled China’s stature as the top solar photovoltaic manufacturing country. Undeniably, China has grown tremendously from a small rural solar program in 1990 to become a global leader in renewable energy sources. Their rise to stardom has changed the economies of solar worldwide. China’s solar capabilities have eclipsed the US name and fame, which invented the technology, still holds most of the world’s patents on solar energy, and spearheaded the industry for over three decades.

Since 2004, China has been producing solar manufacturing parts such as polysilicon feedstock, cells, modules, and wafers. By 2008, as more Chinese firms commenced their purified silicon production, it became the largest PV manufacturer globally, with 98% of the product shipped overseas. Today, China is the lead manufacturer of PV panels for both residential and commercial, competitively defeating Europe, the United States, and Japan. As China monopolizes this supply chain, governments and policymakers are cautioned to work against it and kickstart their domestic production. However, several constraints limit countries from entering the solar supply chain.

The Indian labor costs, overheads, and entire manufacturing processes are 10% higher than in China. Subsequently, the entire production process is 20% cheaper than costs in the US and 35% lower than those in Europe.

But how did China come about to lead the solar market even in the competitive environment?

Opportunistic on the Global Solar Gut

During the financial crisis, China took hold of the export markets, supplying solar gear, thus, reducing the prices. This decline in solar gear prices was due to the production swelling and supply-demand mismatch. By 2011, wafers, solar cells, and module prices were reduced by a significant margin. As the global production reached 20.5 GW or (160,000 metric tons, the price of solar components was only $1.7/watt. China alone produced 10GW solar cells, accounting for 50% of the production while exporting 90% of its manufactured solar cells.

Several hit by the Chinese exports, the US led an inquiry and imposed anti-dumping and countervailing duties against China in 2012. As a result, China’s US exports declined, and its solar PV manufacturing profitability reduced from 30 to 10% in 2011. The same was reported by the European Union in 2012, which imposed restrictions thereafter.

This asymmetry between demand and supply contributed to China’s emergence as a global solar giant.

Government’s Support for Solar PV Manufacturing

The Chinese government has strongly supported the development of its solar manufacturing industry for a long time. China’s Ministry of Science and Technology program, created in 1999, empowered innovation in small tech firms. Some of the measures followed are:

- Innovation fund for small tech firms

- Refund or land fee and tax exemption that includes corporate income tax, VAT, and interest on loans

- Refund or relaxation in electricity consumption fees

- Loan guarantees are given by the government or similar entities

- Easy loan and credit facilities by government and state banks

PV Solar Deployment Policies

When it comes to promoting renewable living, China has made a conscious effort to accelerate solar PV installation by tackling related financial and regulatory barriers. In 2009, the Chinese government introduced a national PV subsidy to promote PV applications and rooftop solar systems. This turned out to be a landmark decision for China’s PV market. Another national subsidy package, the Global Sun Program, was launched that promoted the subsidizing of 600MV of PV projects. This project also saw the price discovery of solar PV projects in different geographic locations. As a result, the solar installation ramped up to 6500MW in 2012.

The Growing Domestic and Global Demand for Solar PV

China is the most populous country and is the largest greenhouse gas emitter. However, the Chinese president’s pledge to achieve carbon neutrality before 2060 in the UN General Assembly has created a domestic incentive for China to boost the solar industry. To meet the terms of its pledge, China must raise its solar and wind generation to 11% of its total consumption in 2021.

The soaring-high global demand has fuelled the growth of the Chinese solar industry. The US heavily relies on low-cost solar modules developed by China, which are imported from Vietnam, Malaysia, India, and Thailand.

Rising raw Materials Costs led to Higher PV Costs

Although the solar market is growing its market size, the industry is not without its challenges. Polysilicon, an essential component of solar panels, is experiencing a price surge due to inconsistent supply, currently at a crisis point. It is why solar panel producers have raised solar component prices by 20-40%.

Way Forward

With the rising solar power, countries worldwide are starting their domestic solar PV manufacturing to improve business opportunities and accelerate growth. Several governments worldwide are lowering taxes and import tariffs on solar equipment and promoting national solar manufacturing and development.